Eyes on China: Aviation Recovery Gathers Pace

- 2023-04-24

.jpg)

Philip Kwok, Manager-Economics, ACI Asia-Pacific

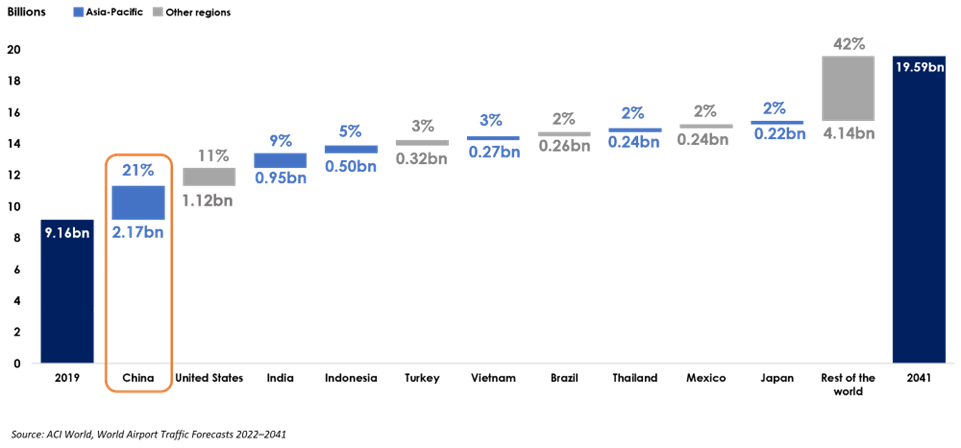

Airports Council International (ACI) estimated that China would contribute about 21% of global passenger traffic growth in the next two decades and overtake USA as the largest aviation market in the world before 2035. ACI Asia-Pacific’s upcoming mission to China will strengthen its engagements and collaborations with airports, regulators, industry associations and financial institutions in several areas, including capacity building, data exchange and environmental stewardship.

Unprecedented crisis for aviation in China

COVID-19 related restrictions in China in the past three years were stringent to say the least. Cities with millions of habitats were locked down for weeks with only hours of notice because of a handful of cases, inter-province travels required Polymerase Chain Reaction (PCR) tests and self-isolation, while international travels required proof of vaccination, pre-departure tests, tests on-arrival at one of the 16 designated first airports of entry1 and mandatory quarantine for up to three weeks at state facilities.

Before the pandemic, China was the second largest aviation market in the world, mainly due to its sizable domestic market and rapidly growing international traffic. In 2019, Chinese airports collectively served over 1.3 billion passengers, over 1 billion more than India in third place. However, domestic lockdowns and international travel restrictions halved the passenger traffic.

China’s economic growth has been exponential, with the Gross Domestic Products (GDP) grew at an average rate of 9% per year between the start of the millennium and 2019. As COVID-19 related restrictions are being removed and that economic activities began to resume, the International Monetary Fund (IMF) expected China’s GDP will grow at around 5% in 2023 and 2024, faster than the average of emerging markets and developing economies.

The latest statistics from the Civil Aviation Administration of China (CAAC) showed that Chinese airports only served about 520 million passengers in 2022, when most parts of the world began to relax travel requirements.

Such reduction in traffic severely affected the financial health of the entire aviation ecosystem of China, particularly airport operators. ACI Asia-Pacific Airport Industry Outlook data showed that airport operators continued to be in distress, with 10 consecutive quarters in the red both in terms of EBITDA and net profit margins since Q2 20202.

The start of recovery

On 26 December 2022, the National Health Commission (NHC) of China announced the removal of flight restrictions for international travel to China, and mandatory PCR test and quarantine requirements for international arrivals, effective from 8 January 2023.

According to Trip.com, bookings for outbound flights from China increased over 250% and rocketed over 400% for inbound flights on the back of NHC’s announcement. Yet, reactions from governments outside of China were not so positive, with many feared the outbreak of the Omicron variant in China at the time would spread to their countries, and decided to reimplement travel restrictions on passengers originated from China. As for international airlines, many were reluctant to immediately change schedules and redeploy planes and human resources from existing routes and operations. Additionally, many Chinese nationals were stuck in the administrative processes of acquiring updated travel documents as passport renewal services in China were suspended for three years.

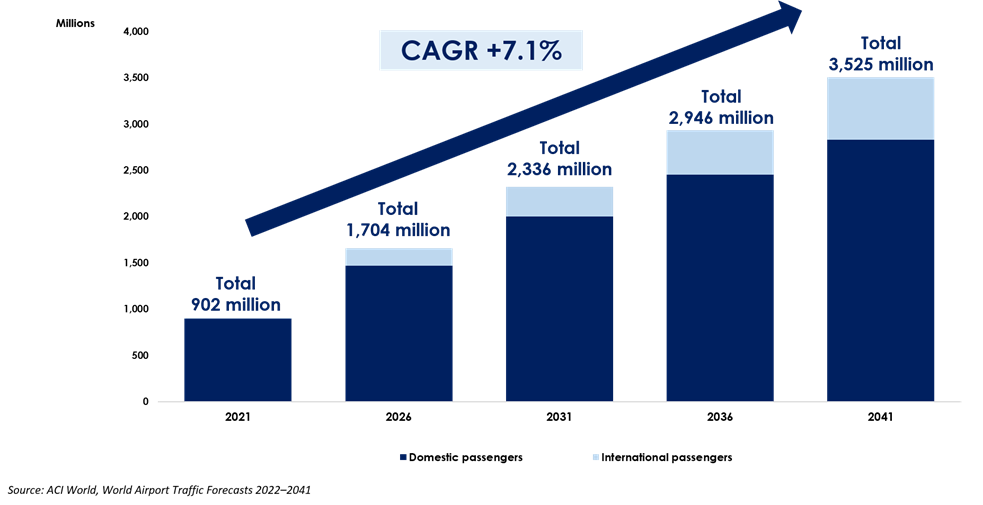

ACI estimated that China’s total passenger traffic would grow from 0.9 billion in 2021 to 3.5 billion in 2041, equivalent to 7.1% increase per year, for 20 years.

Nonetheless, the latest ACI forecast released in February 2023 expects passenger traffic in China to recover in 2024. The Boxing Day announcement was regarded as a pleasant surprise. However, it remains to be seen how much quicker China could recover in light of the earlier-than-expected reopening.

Looking ahead

China’s economic growth has been exponential, with the Gross Domestic Products (GDP) grew at an average rate of 9% per year between the start of the millennium and 2019. As COVID-19 related restrictions are being removed and that economic activities began to resume, the International Monetary Fund (IMF) expected China’s GDP will grow at around 5% in 2023 and 2024, faster than the average of emerging markets and developing economies.

Chinese President Xi Jinping’s written speech at the APEC CEO Summit in November 2022 signified China’s goal to improve the population’s living standards by doubling its middle-income population to 800 million in the next 15 years. To put it into perspective, the additional middle-income population is equivalent to the combined total population of USA and France. The increase in affluence will certainly propel consumer spending and alter spending patterns. We could expect a big shift in terms of spending on recreation and travel at the expense of spending on goods such as food and clothing3.

ACI estimated that China’s total passenger traffic would grow from 0.9 billion in 2021 to 3.5 billion in 2041, equivalent to 7.1% increase per year, for 20 years.

Figure 1: China’s passenger traffic growth (2021-2041)

On the global level, ACI forecasted that total passenger traffic would grow from around 9 billion before the pandemic to almost 20 billion within two decades. China will be the biggest growth contributor with additional 2.2 billion passengers, or 21% of the total global growth.

Figure 2: Top 10 countries globally by passenger traffic growth contribution (2019-2041)

Infrastructure for smarter and more sustainable growth

To meet future demand for travel, significant investments in airport infrastructure will be required. In 2018, CAAC announced their ambitious plan to have over 400 airports in operation by 2035, almost double that of the existing number of airports. China’s plan includes the primary focus of developing airport infrastructure in four regions: the Beijing-Tianjin-Hebei region, Yangtze River Delta region, the Guangdong-Hong Kong-Macau Greater Bay Area, as well as in the cities of Chongqing and Chengdu. As part of an effort to promote economic growth and tourism, China will enhance air connectivity and network coordination among airports, improve air space management and increase capacity by opening more air routes.

Introducing smart technologies and tech-driven operating models have also been a focus of China’s aviation development strategies. In the Thirteenth Five-Year Plan period (2016-2020), China have set up big databases to coordinate industry operations. This industry-wide effort is aimed at facilitating data sharing and promoting effective management and intelligent operations.

Innovation and digitalisation have been key to increase airports’ efficiency as the industry strives to emerge stronger from the pandemic.

On the environment front, in 2022, CAAC issued the China Civil Aviation Green Development Policy and Action that highlights China’s targets in reducing carbon emissions, reducing waste and use of plastic, adopting green construction techniques and increasing the proportion of consumption of green energy and improving energy efficiency. Moreover, China is keen to enhance international cooperation on green aviation and grow to be an important contributor to international sustainable aviation.

The (current) Fourteenth Five-Year Plan (2021-2025) indicates that building quality aviation infrastructure and formulating world class aviation services ecosystem are the focuses of China’s aviation development strategy, with safety, decarbonisation, innovation, mordernisation, efficiency enhancement and capacity expansion as core principles.

ACI Asia-Pacific’s commitment

The high-level industry outlook for China remains positive. As the largest market in our region recovers from one of the most devastating crises in history, ACI Asia-Pacific is committed to representing the interests of our members and supporting the efforts to achieve sustainable future growth. ACI Asia-Pacific is dedicated to engaging and collaborating with industry stakeholders to advocate for the prosperity of the aviation ecosystem.

_______________

1 Chengdu, Changsha, Hefei, Lanzhou, Tianjin, Shijiazhuang, Taiyuan, Hohhot, Jinan, Qingdao, Nanjing, Shenyang, Dalian, Zhengzhou, Xi’an and Wuhan.

2 Based on data from Beijing Capital International Airport, Shanghai Airport Authority, Guangzhou Baiyun International Airport Co. Ltd., Shenzhen Airport Company Ltd. and Xiamen International Airport Group. Airports concerned accounted for 28% of total passenger traffic in China in 2019.

3 The next generation of spenders - The changing tastes of a billion new consumers, HSBC Global Research

- CATEGORY

- COUNTRY / AREA

- Hong Kong SAR

- AUTHOR

- Philip Kwok, Manager - Economics, ACI Asia-PacificACI Asia-Pacific